Do your kids think money grows on trees?

Do your kids want everything they see?

Do they want it NOW?

Are you tired of saying no?

Do your kids show a lack of respect for their things?

Well, those were some of the things I experience with my boys (14, 12 and 10 years old) and I was getting really tired of it.

- It made any trip to the store stressful. One of the boys would ask for something. I’d say no. Said boy would then beg for the ‘must have’ item and I’d say no again. Then the pouting and fit throwing would commence. I’d get mad that they were getting mad and then I’d leave and want to go home instead of finishing errands. I allowed their attitudes to ruin mine. Then that made me madder.

- One time, a new to them Under Armour sweatshirt got stains on it and they didn’t care. The mentality was, ‘doesn’t matter. Mom will get me another one.’ Unfortunately, they were right. Eventually a new UA sweatshirt would appear in their closet.

- One of my boys LOVES shoes. He’d wear one pair, a few weeks later he’d ask for another. I’d buy him another pair if they were on sale and really different than the others. Instead of rotating the two pairs, the older pair would get tossed aside hardly ever seeing daylight again.

- All of this made me sad, angry and frustrated.

I’ve tried to do things in the past to teach about money with chores and such but I always made things way too complicated and it would never last long. So this summer, I started something different and was a bit skeptical on if this would even work knowing my track record with consistency was not so stellar. Several people have asked about what I’ve been doing because the mindset of my boys with money has changed drastically. It’s been amazing actually. So thought I’d share what we’re doing. I have several other friends who have implemented this already and would love to hear from you guys about how it’s going for you. Or do you have other ideas you’d like to share that have worked with your kids? Leave a comment so we all can hear about it!

The info is broken up into a few different sections…

- Get the kids involved in determining the annual budget

- Open up checking accounts and debit cards for each child

- Start saying yes

- Monthly financial meetings and chores

- Sample budget

- The changes I’ve noticed

GET THE KIDS INVOLVED IN DETERMINING THE BUDGET

First thing, I did was sit down with the boys to have them help determine an appropriate annual budget. My middle son who is 12 years old was the one who took most of the initiative and did most of the leg work on this. We determined what categories they would be responsible for and how much we’d put into each category. The categories we felt were best for our family were-

1) Clothing

2) Shoes- yes, one of my boys is obsessed with shoes so we broke that down into its own category

3) School Supplies

4) Entertainment

5) Eating Out

We determined dollar amounts for each category and I automatically put in a large portion of those dollar amounts in their account without any effort on their part. These are things I normally pay for anyway so I’m not expecting them to work for much of it. I did this to put them responsible for the dollars leaving our family.

OPEN UP CHECKING ACCOUNTS AND GET DEBIT CARDS

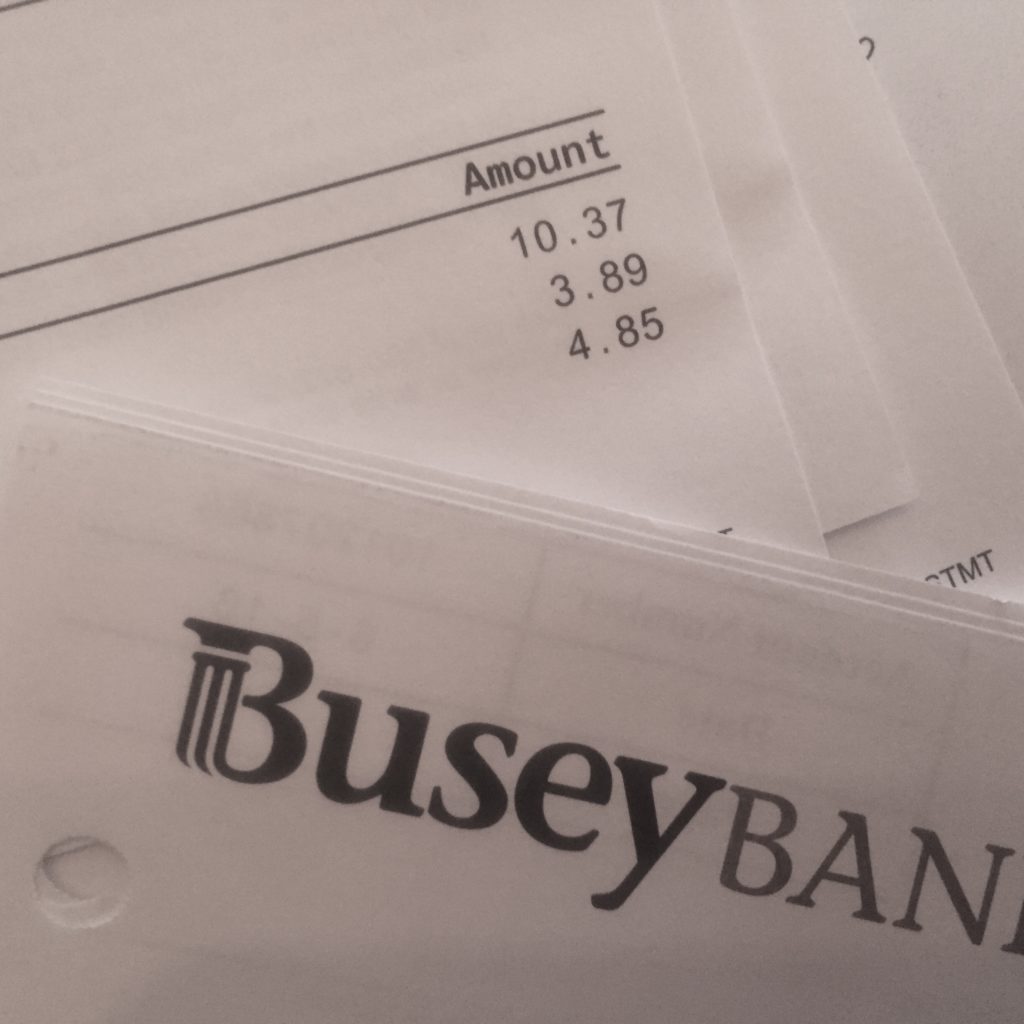

Children over 13 can have a checking account and debit card in their own name. Children under 13 can not. Disappointed I asked a few more questions at my bank and found a way to accomplish my goal. As an adult, I can open up additional checking accounts in my name and they can use the debit cards.

I bank at Busey so I opened up 3 additional checking accounts all linked to my own. I can access all the accounts with the Busey App to monitor balances, transfer money, etc. You can even go in and rename the accounts so instead of it saying account #XXXX, it can say Joey’s Account making it easier to determine which is which.

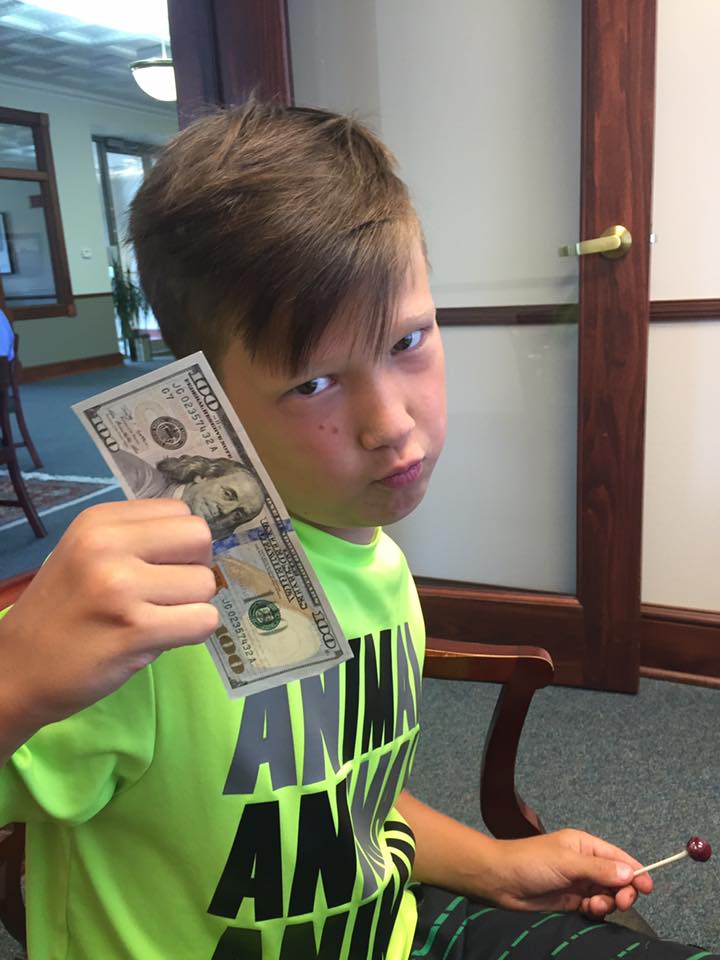

I took Jake in with money and he felt like a big time baller with all his dough! Little did he know, how quickly it was going to go. Jake helped me open up all the accounts starting with the $100 minimum to open up an account.

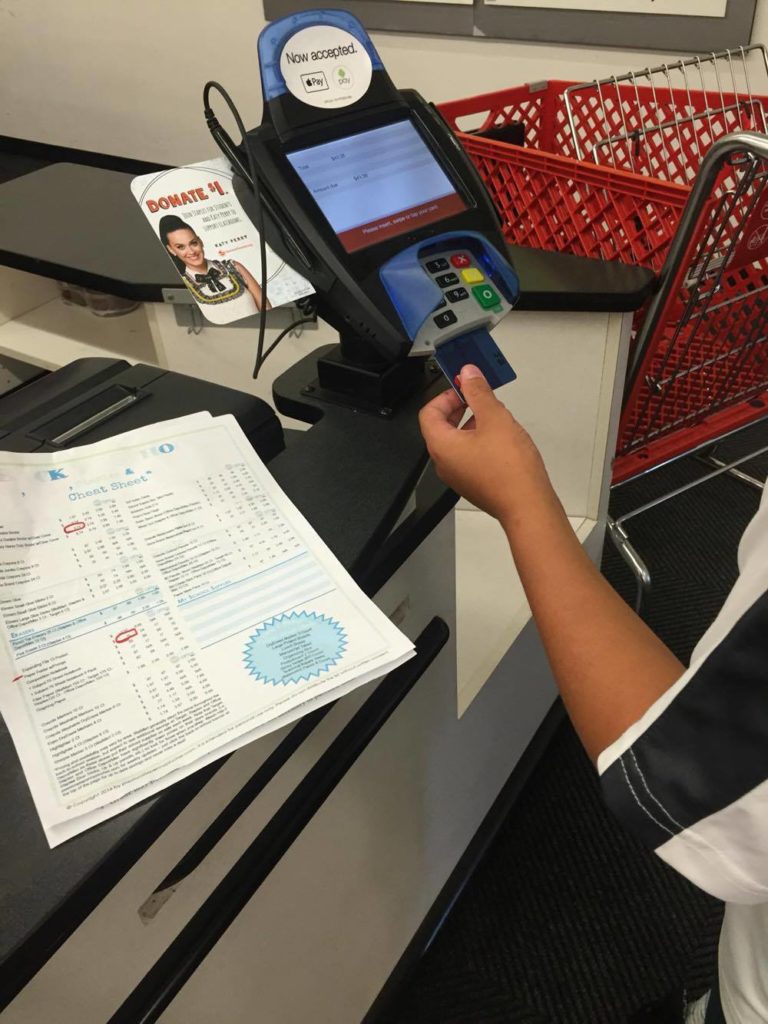

Can they use the debit cards without me? Yes. It’s going to be rare, at their ages, that they ever are using the debit cards without me but I’ve remained in the car on a few occasions to see if they encountered issues when going in to buy a Polar Pop at the gas station or candy at Dollar General. Haven’t yet. So far, so good. When I do go in with them, I get asked a lot of questions because as we check out at a store, we all take turns buying our items. 1 adult, 3 kids and 4 different debit cards. Never have any issues. Most cashiers that notice think it’s really cool and ask more questions about it.

If they ever went somewhere without me and I knew it was absolutely necessary they have money, I would probably just give them cash. I’d hate for them to be a couple hours away with a friend and have a store not allow them to use it. Honestly, more clerks should probably be questioning it for security reasons since obviously two of them aren’t old enough to have their own debit card. But they don’t. I suppose since they run it as a debit and my boys know the pin (each card has it’s own unique pin) it’s less suspicious.

How do I keep track if I give them cash? Occasionally the boys will need $5 for concessions or something else last minute. One option is going to a Busey ATM to withdrawal money without a fee. We have not done that yet. Instead, I will give them cash of my own, then hop on to the Busey app and transfer out the $1.99 for an in-game iPad app purchase, soda or whatever they purchased from their account and into mine.

START SAYING YES!

This has made our trips to stores and restaurants so much more enjoyable. Occasionally I do say no… like if they want to buy a Polar Pop at 7 am or buy dessert if they’ve already eaten 4 desserts at home that day. ha! Other than that, they do not hear no near as often.

Questions from the boys….

Mom, can I get this shirt?

Can I have this candy?

I need this new Xbox game! Can we get it?

My NEW answer… YES! Sure, YOU can buy it. Just remember, you have $xxx in your entertainment budget for the year. Is that how you want to spend it? How much would you have left after that? It’s up to you. Tough choice. Maybe you want to think about it. Oh… you really want it that bad, huh? Well, the choice is yours. You can buy it today. It’s YOUR money. Just think about it and make sure that this is how you want to spend it.

Reaction…. less stomping and pouting these days. More thinking on their part. Often they choose not to buy it. Other times they do and that’s ok. They feel empowered knowing they are making the choice and I’m not dictating every penny.

MONTHLY FINANCIAL MEETINGS AND CHORES

I pay my boys to meet with me monthly to look at their bank account balance, calculate how much money they spent out of each category, etc. Remember up above, I said I automatically provide them the majority of the money for their annual budget… well this is where the other part comes from.

If they want to be able to have every dollar that we determined was fair for each category, it means they also need to earn the money I will pay them weekly for helping maintain the home above and beyond regular chores. Certain chores aren’t an option. They don’t get to choose NOT to put their share of the dishes away or fold the laundry when I ask. That’s part of being in our family. They also have daily and weekly chores and when they do them will get paid every week. In addition to daily and weekly chores, I have lists of other things they need to do to earn the weekly ‘paycheck’.

For instance, I have paid John for photography related work and Joey has earned extra money baking for my Sweet Lemonade Photography client meetings.

Also, I pay them to sit down to look at their finances. I did this to help put pressure on me to make them sit down and talk about their money. As I figured, I am not good about following through well with this but my boys are the ones that keep on me because they want paid. 🙂

SAMPLE BUDGET

Just to keep things simple, I’m gonna share a budget. This is not our budget just nice round numbers.

Annual Budget:

- Clothing- $120

- Shoes- $120

- School Supplies- $120

- Entertainment- $120

- Eating Out- $120

(Edit: I forgot to add that tithing is another one of our categories. That is not a category that can shift around. Tithing is tithing but I wanted them to get in the practice of giving at church. Also, another great category would be savings. My boys have a savings account and when I pay them for photography work, half goes in their pocket and the other half in a savings account they hardly know about. After Becky asked about a rainy day fund, I think it’s a great idea to incorporate the savings into the system they are involved in to reinforce the importance of spending AND saving. For simplicity sake, I’m not adjusting the numbers for this sample budget. We will still use the 5 categories listed above.)

Adding up those 5 categories and dividing by 12 months, the monthly budget is $50 ($120 x 5= $600. $600/12 months).

Then I chose a percentage of the total that I want them to automatically receive and a percentage I want them to earn. My boys automatically get about 2/3 and have to earn the other 1/3. I wanted it to be a large enough percentage that they really didn’t want to go without. Trying to ensure they put in the work. 🙂

In this case let’s say, I want to automatically give them $40 and have them earn the rest. So I might put $40 in their account on the first of each month. Then at the end of the month, I’d give them an additional $2 for every week they completed the chores satisfactorily (that’s up to $8) and pay them another $2 to look at their finances. So that’s how they’d get the full amount of $50 in this example.

Again, these are just sample numbers. My boys budgets are larger than this because I want it to be a feasible amount to take care of everything they need. Clothing budget needs to have enough for summer and winter clothes, winter coat, dress shoes for chorus, etc. I don’t want to start making exceptions and saying, “ok, well I will buy your coat.” Exceptions lead to more exceptions and then that defeats the purpose of this system. I want them to really think about all their expenses in these categories and make choices and learn from them. As you get started on this, it’s just a guessing game like it was for me. I imagine I’ll adjust the numbers as we go along. And as the boys get older, things will probably continue to change.

A little more detail about how we utilize each category-

- Clothing- the boys buy everything they want or need with that budget. Jeans, shirts, socks, undies, hats, special outfit for band and chorus concerts.

- Shoes- pretty obvious. Just for shoes. (Jake has purchased 4 pairs of shoes in the last 3 months (thanks to clearance) for the same price as one pair we bought for him that he HAD to have prior to this new budgeting)

- School supplies- Two of the boys fell below their budget by $30-40 after buying everything on the list including pad locks, their ‘fancy pencils’, etc. One child chose to get a new backpack so he used his full amount. They went to Staple’s with price matching sheets to get the best price on everything for almost one stop shopping. We then walked to Dollar Tree for a few things we knew we could get cheaper.

- Eating Out- their budget must be used for all fast food. We get in a bad habit of running through somewhere on our way home cause I don’t want to have to worry about cooking when we get back later in the evening. It’s not good for our pocket books or waist lines. So now, fast food comes out of their pocket and often they choose to wait to eat til we get home to eat cause it’s ‘free’. If we go to a sit down restaurant then I pay for the meal. There is nothing that makes me more mad than spending an extra $10-15 on soft drinks when going out to eat. So at sit down restaurants, I pay for the MEAL but if the boys want anything other than water, then they will pay for that. This is an instance, where after the meal is over and I have paid with my credit card, I will then transfer $2.25 for a soft drink out of one boys account, $4,29 for a smoothie out of another boy’s account, etc.

- Entertainment- this is kind of the catch all category. Anything that isn’t a necessity that I would purchase and doesn’t fit in one of the other categories then it comes out of entertainment. If I take all the boys to a movie, they will each buy their ticket. If they want a new super soft fuzzy blanket (and we already have 10 at home) they will use entertainment fund. If they want to buy a new game or toy, it comes out of entertainment.

If your kids are heavily involved in activities I could see that being a beneficial category. Your categories to work best for you may look a lot different than what we are using right now.

THE CHANGES WE’VE SEEN

- The boys are asking me for things much less often.

- When asking for things, it is asked differently. It’s not “Will you buy me these TODAY?” anymore. I smiled great big when I took the boys shopping for clothes and John said, “I’d really like to get some slippers but don’t want to spend the money. Could you buy me a pair for Christmas?” What?!?!? Hallelujah, the instant gratification we all fall prey to was not present that day. Instead of asking me to buy him a $10 pair of slippers, which in the past I’m sure I would have just bought that day for him, he’d like to receive a pair as a gift 3 months later. Wow!

- Shopping trips are less stressful and dare I say even kinda fun with my boys.

- The boys are hitting the clearance racks first. Jake bought new shirts at Wal-Mart for $1 each so he could (no surprise here) afford to buy knock off Tims at Wal-Mart too. Yeah, I’m talking like the cool kids now. ha! I just learned that those yellow work boots by Timberland that were popular when I was in school are back in style and the kids in the know call them Tims.

- The boys are better realizing WANT vs NEED and making smarter choices. I told the boys that after 6 months of staying within these specific budgets, that we could discuss moving money around. If they have a lot extra in clothes, that we could discuss how much they could move over to entertainment. Entertainment is a wide category…basically anything fun, movie tickets, xbox games, sporting equipment, pool toys, snow sled, comfy new blanket we don’t need, etc. So my boy Jake who loves clothes shopping chose to not even go in the store when Joey and John were getting pants last week. His response, “I don’t need anything.” You know why he doesn’t need anything? Cause he’s planning on saving up his clothing money and putting it towards a new scooter next spring. And he also has big plans of turning his bedroom into a gaming center. Now that’s gonna take a lot of money so he’s become frugal. I did draw the line at his long term plan to knock down a wall to make his gaming room larger. ha! But other than that, if he can save his money to make purchases on splurges I’m totally ok with it. Never thought he’d have the most money of all 3 boys three months into this new system. Money burns a whole in his pocket. To be honest, even Jake was shocked he has the most! Shocked but very proud.

- Boys are appalled at the prices of things. This makes me laugh at how quickly they appreciate the value of a dollar when it is ‘their money’. I brought Joey home an Under Armour sweatshirt I found at Sam’s Club for $25 (normally $45).

He was so excited about it….until he realized if he kept it, it would come out of his account. He then asked me if I could give it to him for Christmas so it would be a gift instead. I agreed to that. He is 14 years old and hard to shop for so yes, I happily put it up until Christmas. And he doesn’t have to spend $25. Joey has always been wise with his money and rarely buys unnecessary things. I’m proud of the good choices he continues to make.

He was so excited about it….until he realized if he kept it, it would come out of his account. He then asked me if I could give it to him for Christmas so it would be a gift instead. I agreed to that. He is 14 years old and hard to shop for so yes, I happily put it up until Christmas. And he doesn’t have to spend $25. Joey has always been wise with his money and rarely buys unnecessary things. I’m proud of the good choices he continues to make. - When at the Under Armour Outlet earlier this week, John got several things on sale, and also a sweatshirt that was full price. I made a couple comments about the price and wanted to make sure he really wanted that. I told him it was a great looking sweatshirt but at $60 that would require a large chunk of his winter clothing budget. It’s ok if he wants to get it but it’s a lot of money. He bought it so excited to get it. We then went to Old Navy and got a few things. He came up to me excited and said, “look at this sweatshirt mom. It’s almost identical to the UA one and it’s half the price PLUS it’s on sale. I’m gonna get this one and return the other one.” So my boy purchased an Old Navy sweatshirt for $20, then as we were walking back over to Under Armour he was talking in utter disbelief, “I can’t believe a sweatshirt costs $60!?!?!” So proud of him.

- I’m not spending as much. I gotta admit, I didn’t think about this benefit. I’ve always realized I bought more clothes for the boys than they needed, often cause ‘it was on sale’ so I’d pick up a few more things. The ‘extra stuff’ I’d pick up added up really quickly. They have drawers full of clothes but tend to wear the same 5-6 outfits while everything else sits in their drawers til we purge. What a waste. Now, we all go shopping and many of the things I would have purchased prior to this system, I’ll show the boys and ask if they want to buy it and they say no. They are saying no to so many things now that previously with ‘my’ money I would have bought whether they asked me to or not. This has already slowed down our living in excess in the clothes categories. I think, ‘why would I buy something if they don’t love it enough to buy it with their own money?’ So now those things sit on the store shelves waiting for someone else to purchase.

- I am empowering them. That feels great to all of us. I have such pride seeing the boys mature overnight when it comes to money. And I’m sure they appreciate the trust I have in them to use this system, love the freedom to make choices and enjoy the power they have in reaping the benefits of their frugal choices. Dave Ramsey would be proud. 🙂

All in all, I couldn’t be happier with this set-up. It’s simple to do and easy to monitor which will help me keep this going long term. The kids love it too.

Pretty simple system but thought I’d share a little more in detail since several people have asked.

Whether you decide to try this or implement something different, don’t wait! Do it now. It’s never too early to find ways of teaching our kids the value of a dollar. Sure will help them in the long run and seems to be saving me some headache in the short term too which is an added bonus!

XOXOXO,

Heather

Heather is the owner of Sweet Lemonade Photography and co-owner of Sweet Darling Weddings located in central Illinois (Mahomet). Life gave her a bunch of lemons (you can read a little more here) and by keeping her focus on God, finding the positive in each day, and surrounding herself with supporting, loving and encouraging people she has turned those lemons into the sweetest lemonade. This blog has been created to share her heart, her adventures and find ways to bless others. You can contact her at heather@sweetlemonadelife.com.

I’ve been a huge Dave Ramsey fanatic for the past year or so, and I know that a lot of parents struggle with passing along good values and habits to their children. This post just made my heart swell, for some reason. Like, I loved it! How do you think you’ll incorporate overall savings (rainy day fund) into this system? I think that’s the part that I wish my parents would have emphasized more with us when I was their age.

Great question. I’m not exactly sure. I think easiest would be to make a new category for Savings and have it be one they can’t touch. Anytime the boys are paid for work for me, half goes in their pocket and half goes in a savings (one they don’t see) but it makes great sense to incorporate it into what they are involved in. I also forgot tithing category. They have that too and that’s not one they can pull out of to use in another area. Tithing is tithing. 🙂